Itemized Bill Of Sale

The itemized deduction for all state and local taxes is 10000. Maximizing your tax deductions allows you to reduce your tax bill and increase tax savings.

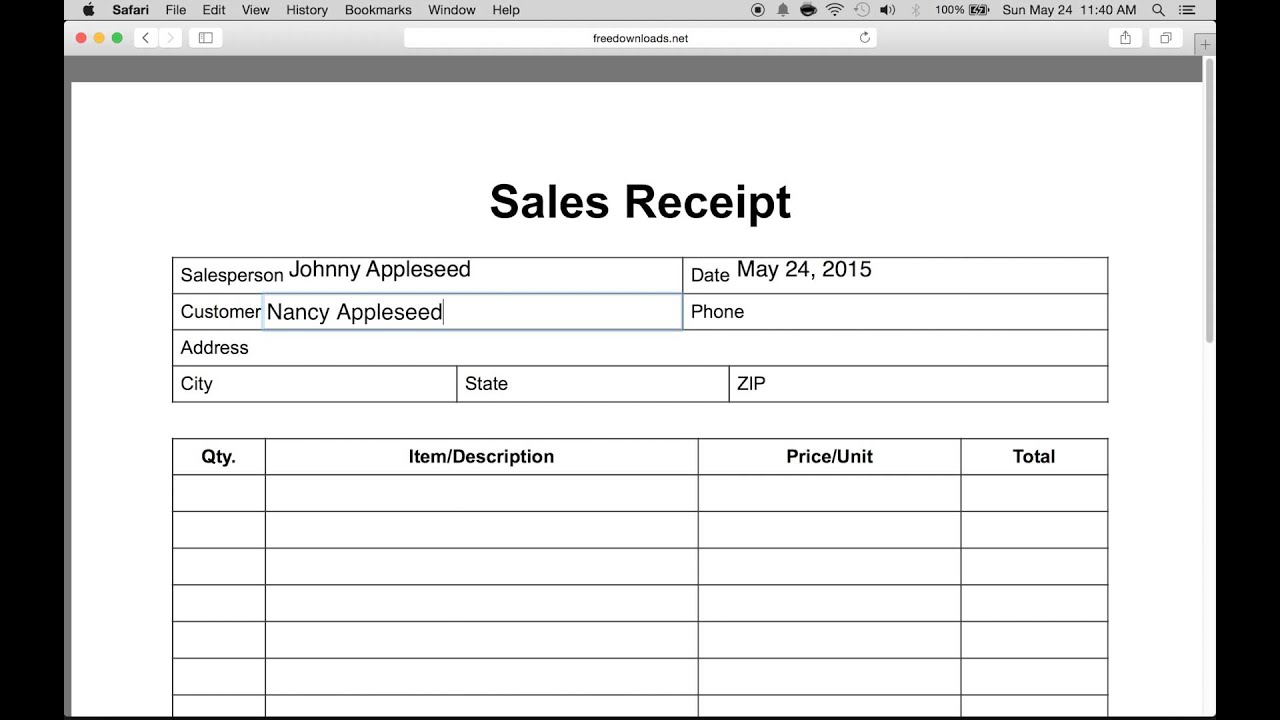

How To Write An Itemized Sales Receipt Form Youtube

Download and fill out the sales receipt previewed on this site by clicking on the PDF Word or ODT buttons.

. State and Local Taxes. 28 Feb 2020 Budget. After offering their services they should issue receipts to the parents to confirm payment for the rendered services.

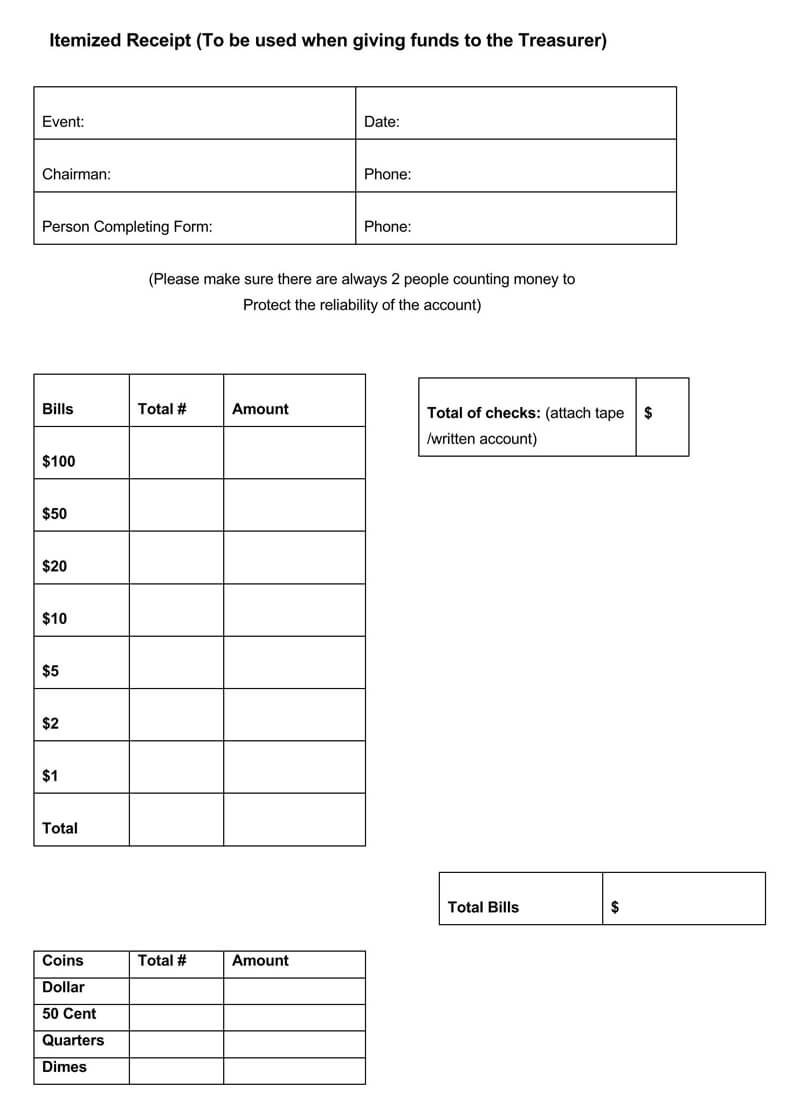

What Are Allowable Schedule A Itemized Deductions. Then enter the receipt cost and tax if any rate. Key differences between bills and invoices relate to their details of the sale documentation type order numbers and payment terms.

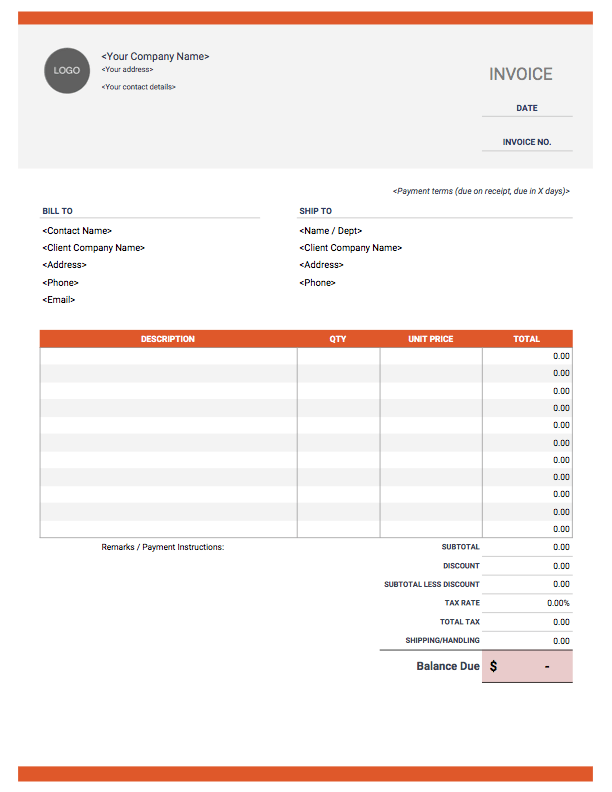

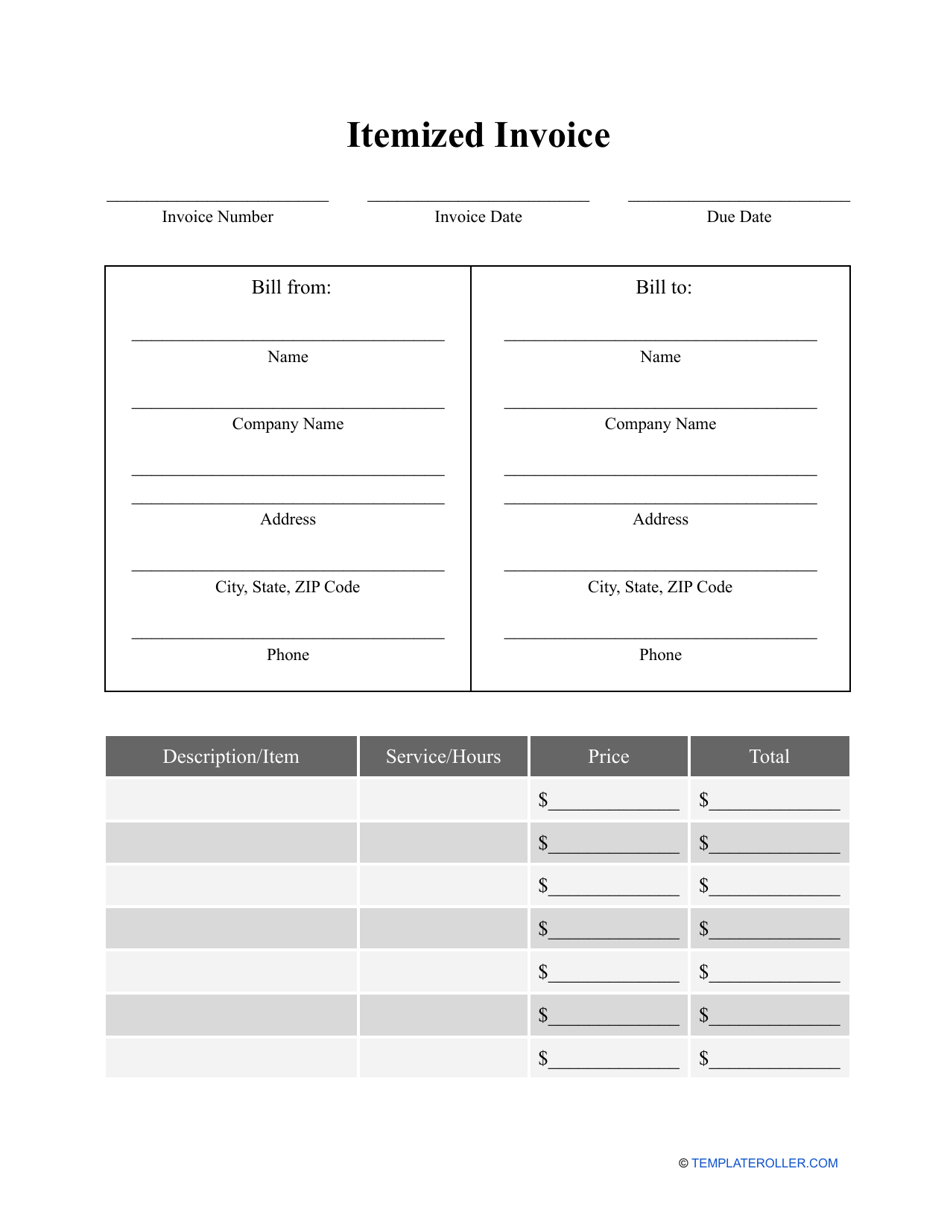

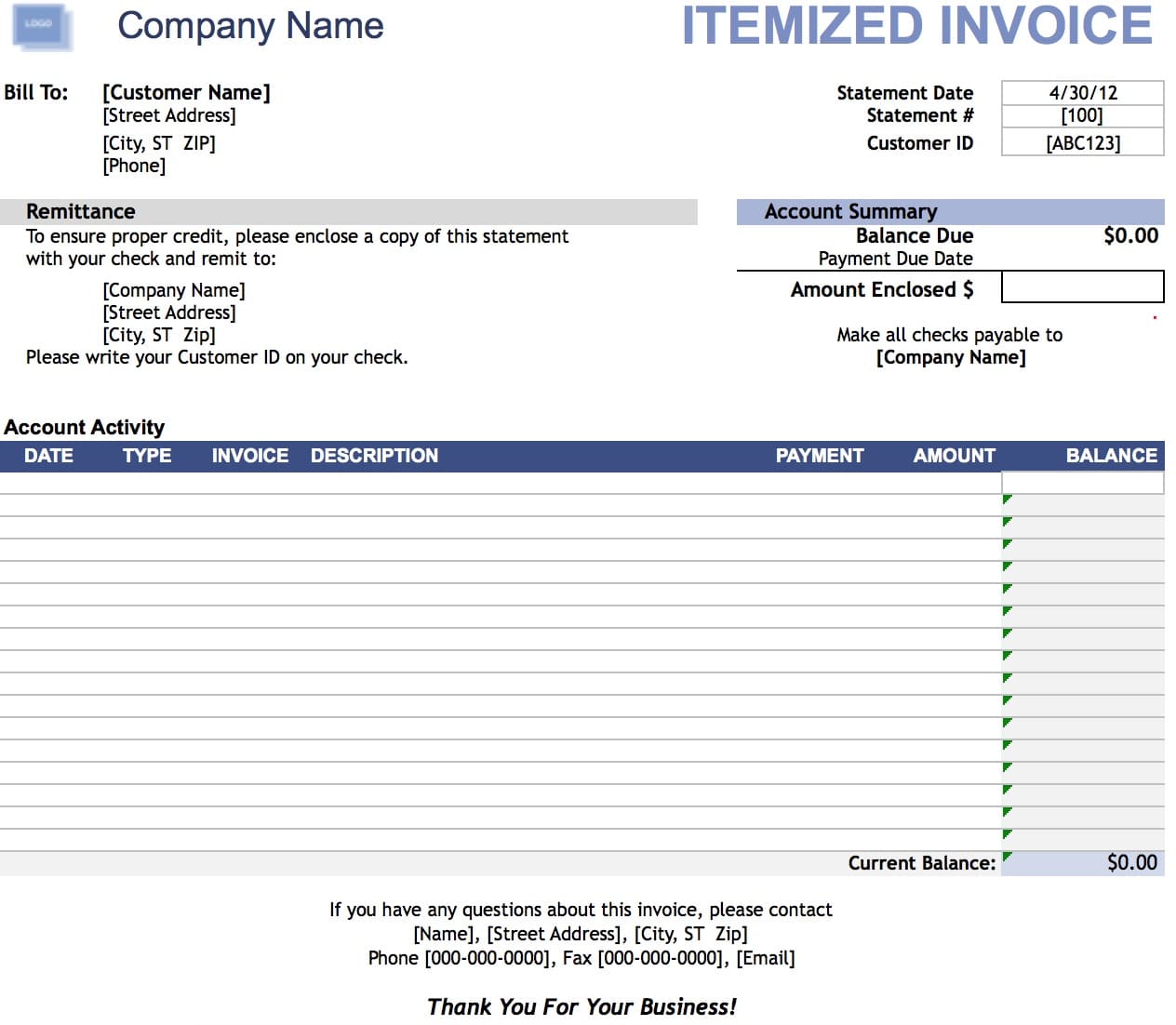

This publication covers the following topics. An itemized invoice is a document that is used to provide an itemized statement for a client when goods andor services are purchased. Bill Pay Checklists Read More.

First enter in business name business address business telephone business location. The template of an original receipt contains essential information like the name of the company the purchased goods or services and the payment method used. Updated June 24 2022.

For example a net 45 payment is a common phrase when referring to an invoice that needs to be paid within 45 days. Now while we at Bill Dodge Auto Group maintain this inventory of quality used cars and crossovers and SUVs the actual vehicles listed will constantly change as we continue to bring in more trade-ins and resell them off our lot. In this guide youll learn about the itemized deductions available in California.

Price does not include 599 doc fee tax title or inspection fee unless itemized above. A valid daycare receipt should include vital details such as the daycare name address date contacts information about the child receipt number name of. Each item or service would be listed per line.

Medical and Dental Expenses. It may come in the form of a point-of-sale an invoice or even an order confirmation. Invoice Use to bill a client for the sale of a product.

Our tool allows you to enter receipt information and create custom receipts instantly. Here is a list of allowable Schedule A itemized deductions. You can still claim certain expenses as itemized deductions on Schedule A Form 1040 Schedule A 1040-NR or as an adjustment to income on Form 1040 or 1040-SR.

If the receipt is an itemized grocery pharmacy style receipt you will need to also enter each item. Please note starting in 2019 medical and dental expenses will be limited to amounts over 10 of AGI. May not be.

Daycare centers take care of young children when their mothers are away mostly when busy working. All items would be calculated and the final amount with tax and any additional charges would be accurately displayed at the bottom of the form. Adobe PDF Microsoft Word docx or Open Document Text odt 1 The Sales Receipt Can Be Acquired On This Site.

With tax season fast approaching now is the right time to look into the deductions you can take advantage of when you file your Federal tax returns. An invoice is a type of bill that includes an itemized list of those products or. Miscellaneous itemized deductions are those deductions that would have been subject to the 2-of-adjusted-gross-income AGI limitation.

19 Mar 2021 Purchase Receipts Read More.

Itemized Invoice Template Download Printable Pdf Templateroller

Free Itemized Receipt Templates Word Pdf Simple Formats

Free Itemized Invoice Template Word Pdf Eforms

Free Itemized Invoice Template Pdf Word Excel

20 Free Itemized Receipt Templates Word Excel Pdf

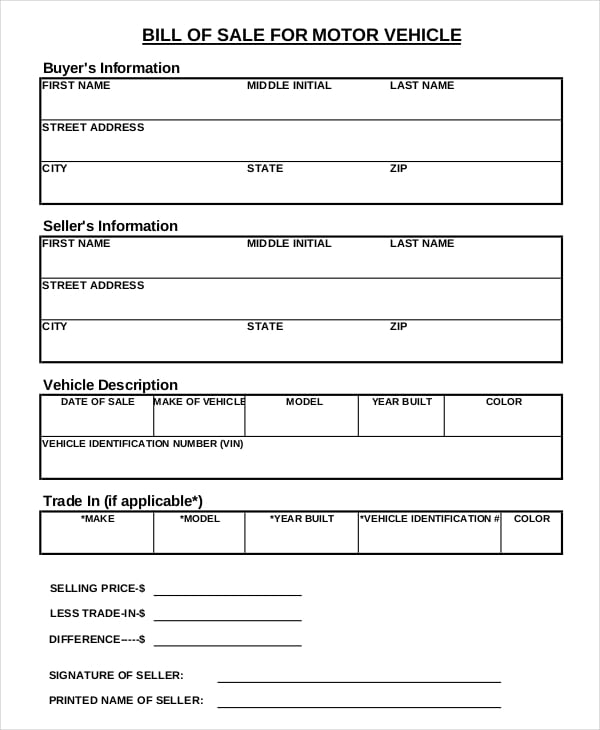

Auto Bill Of Sale 11 Free Word Pdf Documents Download Free Premium Templates

Free Itemized Receipt Template Word Pdf Eforms

Free 8 Itemized Receipt Templates In Excel Ms Word Number Pages